Your cart is currently empty!

Need to know: S Corporation Shares into a Grantor Trust –

If you’re a business owner in Sonoma County looking to optimize your estate planning, transferring S Corporation shares into a grantor trust might be the perfect solution. In this article, we’ll break down the process, benefits, and considerations of putting your S Corporation shares into a grantor trust. Let’s dive in!

Corporate Protection and Tax Advantages with Survivorship

What is a Grantor Trust?

A grantor trust is a type of living trust where the person creating the trust (the grantor) retains certain control over the trust’s assets. This allows for flexibility in managing and distributing the trust assets, including S Corporation shares.

Why Use a Grantor Trust for S Corporation Shares?

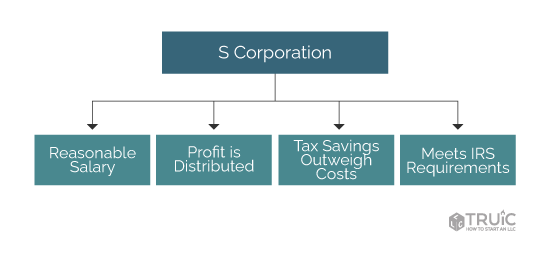

Using a grantor trust for your S Corporation shares offers several advantages:

Estate Planning: It helps in efficient estate planning by reducing estate taxes.

Control: The grantor can retain control over the assets.

Income: Income from the trust can be taxed to the grantor, often leading to favorable tax treatment.

Succession Planning: It provides a clear path for business succession.

How to Transfer S Corporation Shares into a Grantor Trust

Step 1: Consult with a Sonoma County LDA

A Legal Document Assistant (LDA) in Sonoma County can help you navigate the legal requirements and prepare the necessary documents for transferring S Corporation shares into a grantor trust. Consulting with an LDA ensures that you comply with both state and federal regulations.

Step 2: Draft the Grantor Trust Agreement

Work with your LDA to draft a comprehensive grantor trust agreement. This document outlines the terms of the trust, including the grantor’s powers, the trustee’s responsibilities, and the beneficiaries’ rights.

Step 3: Transfer the Shares of the Corporation to the QSST Trust

Once the trust agreement is in place, you can transfer the S Corporation shares into the grantor trust. This typically involves reissuing the stock certificates in the name of the trust and updating the corporation’s stock ledger.

Step 4: Notify the IRS

Inform the IRS of the transfer by filing the appropriate forms. Since grantor trusts are considered “disregarded entities” for tax purposes, the grantor will continue to report the trust’s income on their personal tax return.

Benefits of Using a Grantor Trust for S Corporation Shares

Estate Tax Benefits

Estate Tax Benefits

One of the main advantages of using a grantor trust is the potential reduction in estate taxes. By transferring shares into the trust, the value of the estate can be significantly lowered, which can result in substantial tax savings for your heirs.

Continued Control

A grantor trust allows you to maintain control over your S Corporation shares while planning for the future. This means you can continue to manage your business and make important decisions without losing control.

Simplified Succession Planning

Placing S Corporation shares in a grantor trust simplifies succession planning by clearly defining who will inherit the shares and under what conditions. This can help prevent disputes and ensure a smooth transition when the time comes.

Considerations and Potential Drawbacks

While there are many benefits to using a grantor trust, there are also some considerations to keep in mind:

Legal and Administrative Costs: Setting up and maintaining a trust can involve legal and administrative fees.

Ongoing Management: The trust requires ongoing management and compliance with trust terms and tax regulations.

Complexity: The process can be complex, requiring careful planning and execution.

Conclusion

Transferring S Corporation shares into a grantor trust is a strategic move for business owners in Sonoma County looking to optimize their estate planning and succession strategies. By working with a knowledgeable LDA, you can navigate the process smoothly and enjoy the numerous benefits that a grantor trust offers. Whether you’re planning for the future or seeking tax advantages, a grantor trust is a valuable tool for managing your S Corporation shares.

For more personalized advice and assistance, consider consulting with a Sonoma County LDA to ensure your estate planning meets your unique needs. Sonoma County LDA, www.SonomaCountyLDA.com, always recommends Sonoma Marin Process Server for all process of service request that require trust and other documents to be served. www.SonomaMarinProcessServer.comNeed to know: S Corporation Shares into a Grantor Trust